- Main Number

(855) 667-3655 - Emergencies

(800) 453-2530 - Crossing gates, signals & rough crossings

(800) 453-2530 - Environmental Spills

(800) 453-2530

Rail is a critical component to a thriving EV supply chain

Norfolk Southern is the rail industry’s largest shipper of auto products in North America. Serving automotive manufacturers and suppliers is a growth opportunity as the electric vehicle (EV) industry takes off. Overall, the number of EVs sold in the U.S. has tripled since 2020.

“Market researchers are forecasting that by 2030, 50 percent of new vehicle sales will be an EV model – that translates roughly to 8 or 9 million EVs on the road by 2030,” said Jacob Bowen, Manager Market Research & Forecasts at Norfolk Southern. “Congruently, the global lithium-ion battery manufacturing capacity is expected to grow tenfold by 2027.”

Since 2020, companies in the sector have invested approximately $85 billion into the manufacturing of EVs, batteries, and charging equipment. In 2022 alone, $13 billion in domestic EV manufacturing investment was announced – more than triple the investment in 2020. Further, $24 billion will be invested in batteries alone – more than 28 times the investment in 2020 – and over $700 million to support EV charging.

What’s behind the rise of the EV industry?

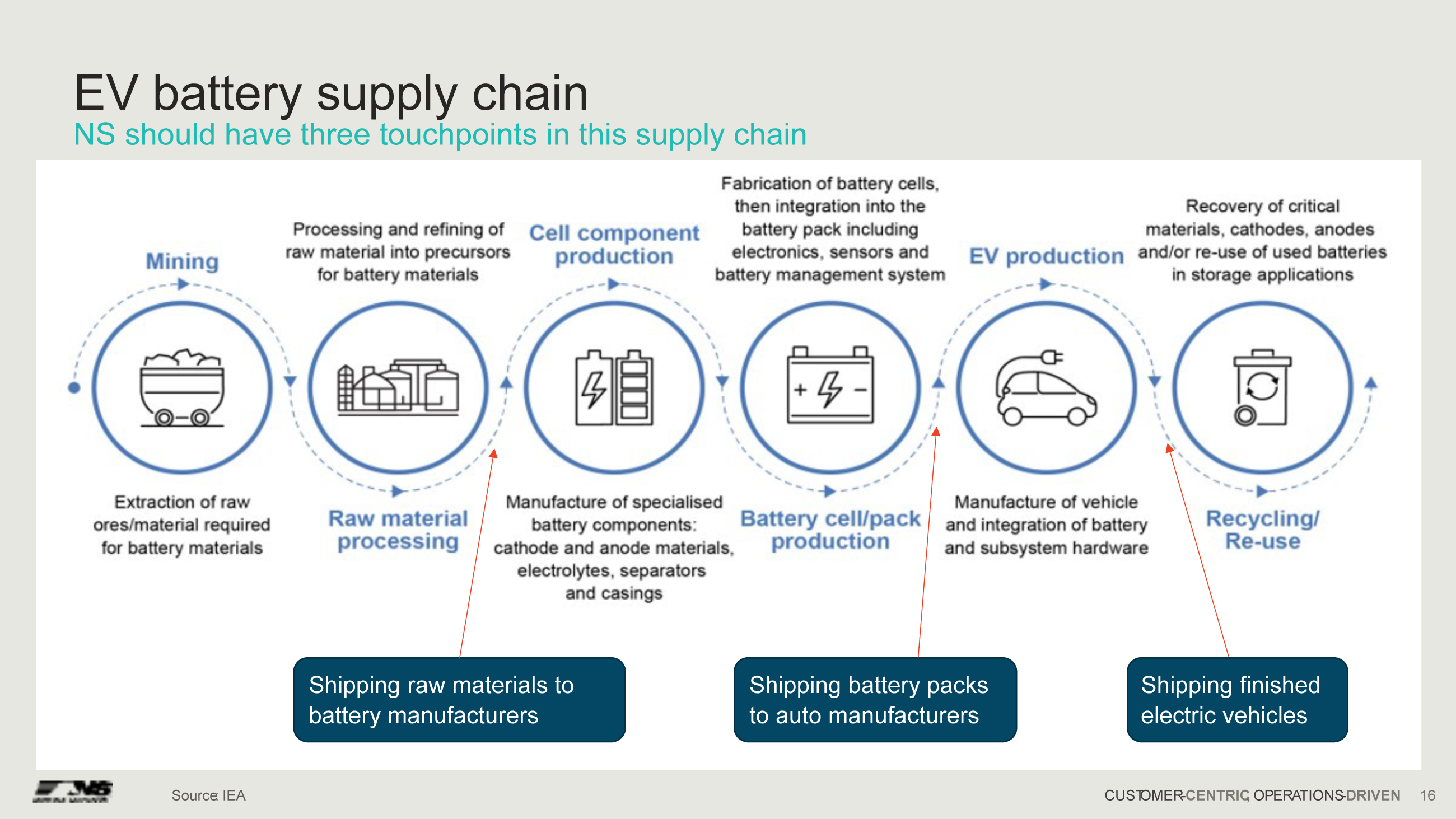

Automakers have sought to boost domestic production of EVs and batteries for years, in part because of supply chain disruptions and the costs of shipping batteries overseas. Consumer demand and commitments by the corporate sector to reduce their carbon footprints have only added to the urgency. This has led to companies aggressively searching for U.S. manufacturing facilities to produce EVs, batteries, and the components that make up the batteries which supply the industry. Additionally, companies will also have to transport equipment and materials used to support production – all areas where rail can play a critical role.

What the industry experts are saying

Recently, Norfolk Southern hosted an Electric Vehicle Symposium. The audience included Norfolk Southern experts from Market Research, Automotive, Domestic and International Intermodal, Operations, Industrial Development, Real Estate, Metals and Construction, and more, as well as a panel of industry experts. The panel included:

- • Harrison Kreafle – Director, Anode Technology NOVONIX Anode Materials

- • Randy Wright – Senior Advisory JFP Holdings

- • Randy Abdallah – Executive Vice President, Wallbridge Aldinger

- • Seokchan Moon – SK Battery America

During the panel, a theme emerged: rail is critically important to the EV supply chain. How important? The moderator posed this question: “What factors are manufacturers looking to achieve in the site selection process for EV battery pursuits?”

In response, one of the experts shared that access to rail was third on the list in terms of priority when companies choose a home for their operation. Other factors were access to good, dependable labor; land to accommodate suppliers; robust power supply with low energy cost; proximity to raw materials; and decision-maker buy in.

As Norfolk Southern works to help our customers reach their own sustainability targets and reduce our own carbon footprint, our support of this emerging industry will help us to further our goals and our customer’s goals.

Norfolk Southern ready to support EV growth

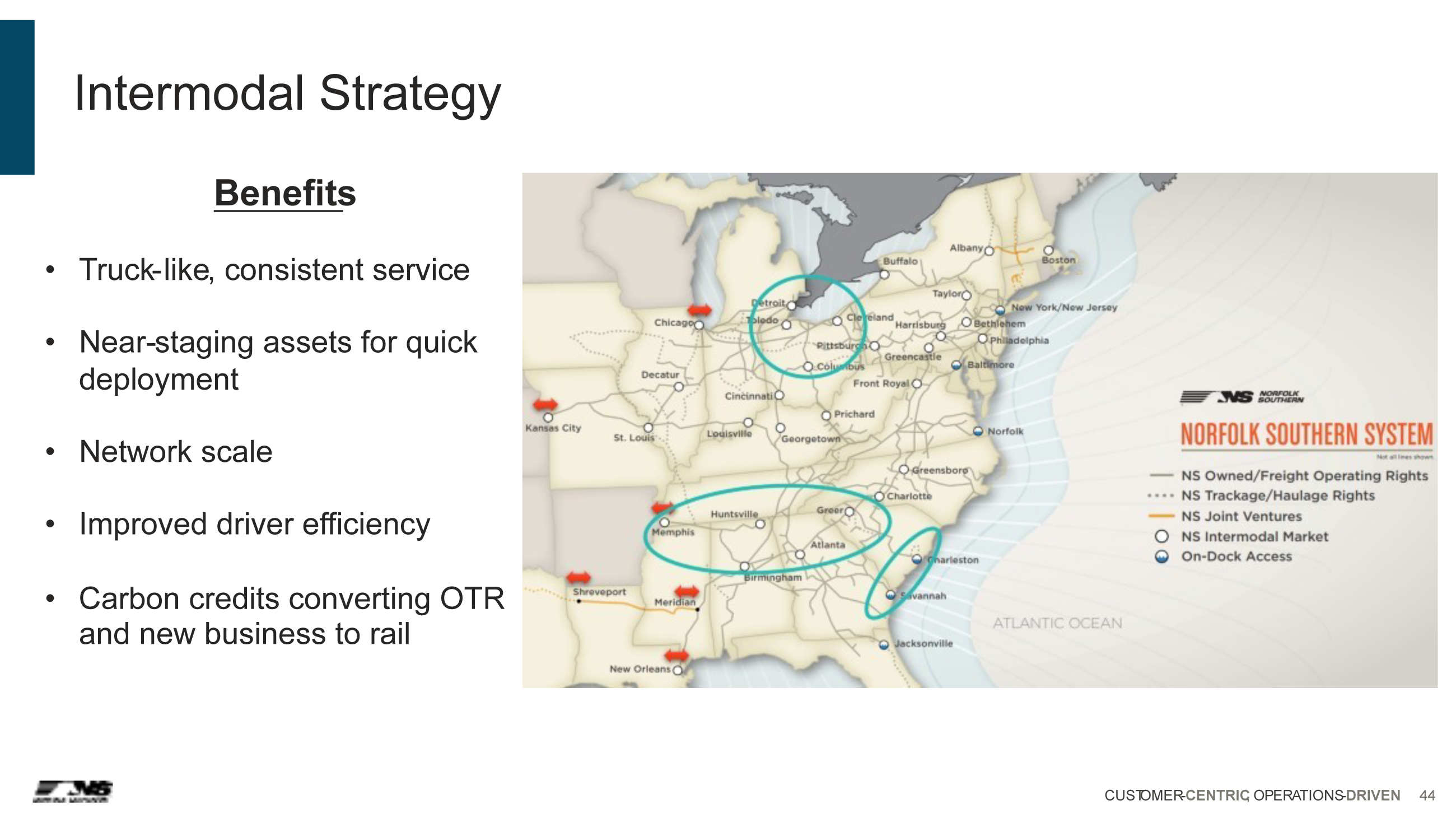

The Norfolk Southern team is working to identify and flesh out opportunities across our 22-state network.

The lifecycle of the EV supply chain, and where Norfolk Southern can enable growth for this emerging sector of the U.S. economy.

Identifying real estate development opportunities for manufacturers and suppliers

“Companies looking to locate or expand in this space are tapping into Norfolk Southern’s world-class Real Estate and Industrial Development resources,” said Jacob Weir, Sr. Industrial Development Manager. “We’re helping them do everything from finding available sites to conceptualizing rail infrastructure in their build out. They’re demonstrating that the ability to have rail service is important in their site selection decision. We’re working projects with manufacturers and suppliers alike, and activity levels remain high.”

Take the recent Scout Motors, Inc. announcement in South Carolina for example. As Kathleen Smith, VP Business Development and Real Estate commented when the project was announced, “We collaborated with Scout Motors and their project partners from the outset. This included site conceptualizations and helping them understand how rail infrastructure could optimize the operations and economics, all along with the sustainability benefits of rail transportation.”

Shipping base materials and supporting other vital American industries

Norfolk Southern’s strong partnership with steel manufacturers will be an important aspect as we look to help transport their materials to EV manufacturers and suppliers.

“Cleveland-Cliffs, the largest supplier of steel to the U.S. automotive industry, produces electrical steel at a plant in Butler, Pennsylvania,” reported Tyler Rosenberger, Group Manager Metals. “Now, the company is spending more than $30 million to restart an idle electrical-steel rolling line at its Zanesville, Ohio, mill that will produce additional electrical steel for auto motors and lead to good paying jobs for American workers.”

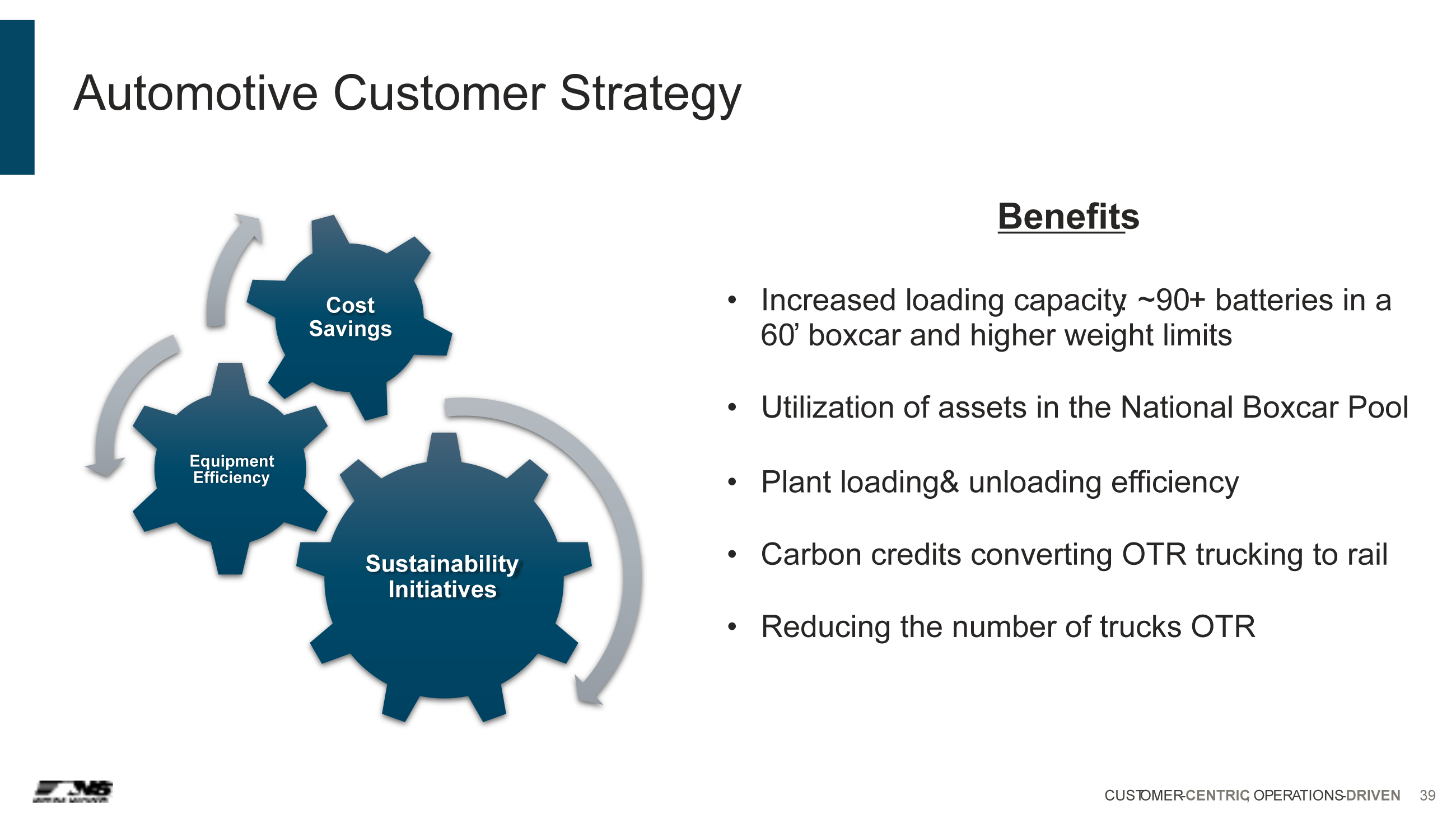

Supporting automotive manufacturers

“Co-locating rail alongside auto manufacturers improves the flow of their production but has an important sustainability benefit,” said Account Manager Automotive, Tyler Boone. “Consider Toyota, where Norfolk Southern will have direct rail access to serve their new plant in Liberty, North Carolina. A lot of these lanes of traffic will provide batteries to multiple locations around the United States. They were able to come directly to us, because they wanted to get a better understanding of how rail would factor into their supply chain.”

Intermodal:

“This market needs the right service product, the right lanes, and the right speed,” said Group Manager Business Development, Michael Williams. “Norfolk Southern is and will continue working on meeting these needs to service existing customers, bring on new volume, and convert over-the-road share to rail. We are building network capacity, and we have the advantage of a good reputation with our automotive customers and suppliers, the strategic terminal footprint, and the best shipping partners in the industry that will work in our favor.”